Overview

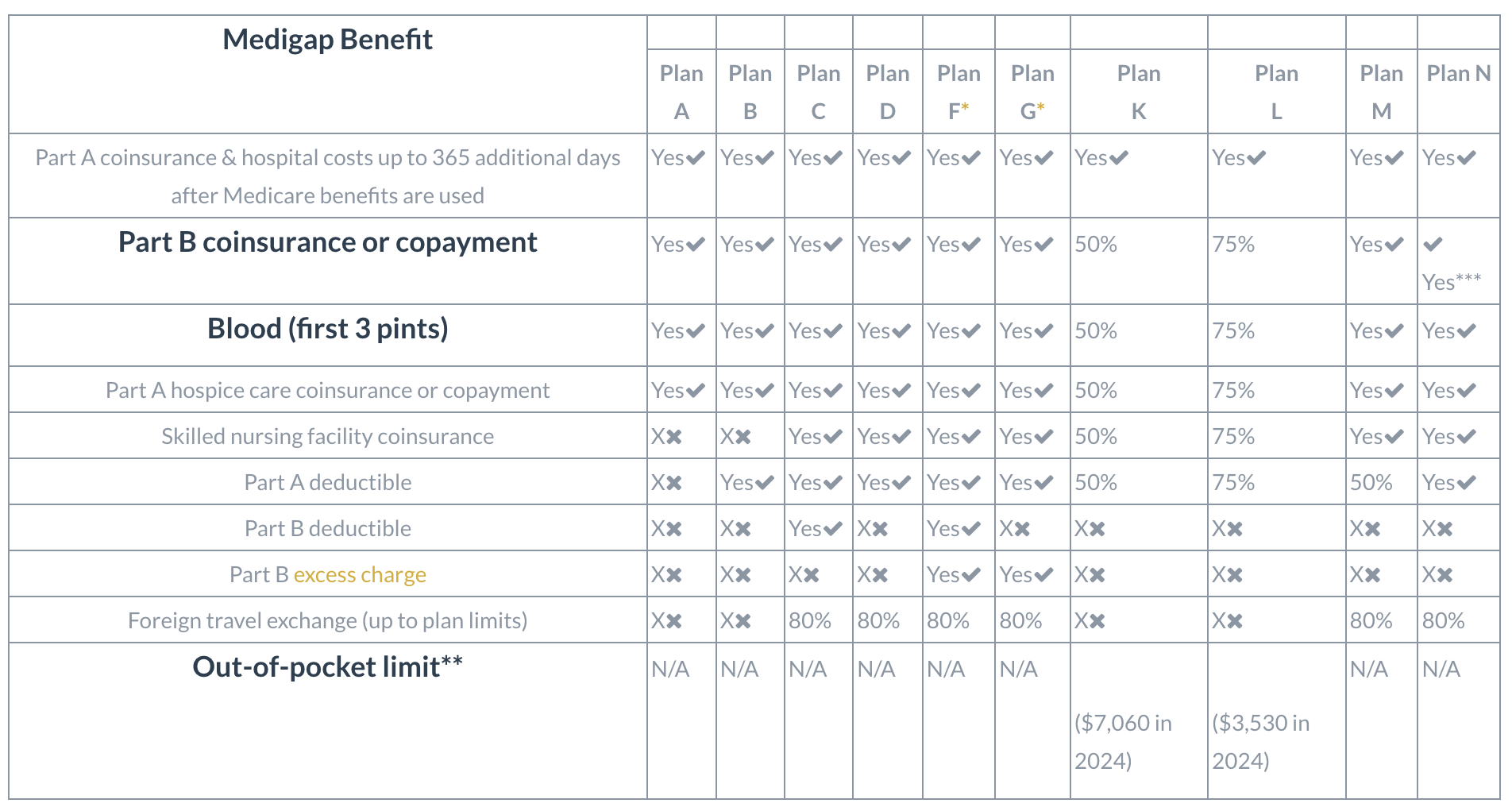

Medicare supplement or Medigap plans are an avenue for Medicare eligible individuals to recieve coverage in the gaps that are left over after Original Medicare pays their portion of medical costs. It is important to understand the different plans, their level of coverage in each area, and what you will be paying for.

Standardization

Medicare supplement plans are standardized across carriers. This means that CMS has required all like plans to carry the same benefits from carrier to carrier. The plans carry a letter (A, B, C, D, F, G, K, L, M, N) and same lettered plans only differ on pricing.

Noted Plan Highlights

Comparing Plans

Before choosing a Medicare supplement plan to enroll in, it is extremely important to consider your healthcare needs and the amount you are willing to pay for coverage. These plans vary drastically in price from carrier to carrier, so you may want to work with a licensed Medicare agent who has access to these types of plans in your area. The licensed Medicare agent will be able to provide you with a cost comparison and illuminate some plan aspects you may need to consider. It is also important to consider that what may work well for your neighbor may not work well for you, everyone's healthcare needs are different and coverage should reflect your needs.