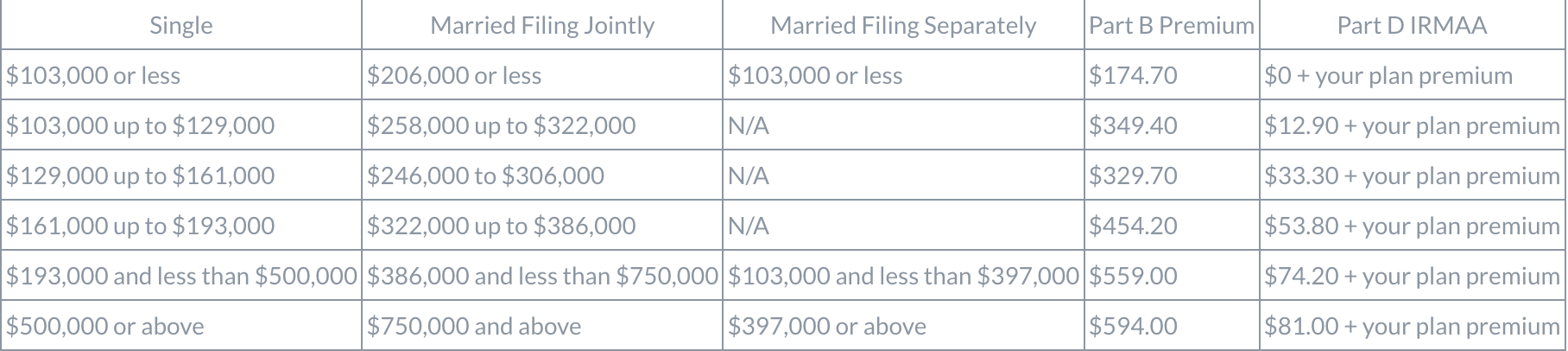

When enrolling in Original Medicare A & B along with Part D (prescription drug coverage), you may be required to pay a higher premium figure per month for B & D coverage. The Social Security Administration determines this Income Related Monthly Adjustment Amount (IRMAA) from your tax return two years prior. If you enroll in Medicare in 2024, they will review your tax return from 2022 to determine this outcome. Note that if you filed your taxes jointly with a spouse the SSA will factor their income into account as well. Below is the 2024 table showing tax return income brackets the SSA uses to determine your IRMAA per month for Parts B & D:

Please be aware that you could have an IRMAA along with a late enrollment penalty if you did not have a valid waiver for Part B & D and delayed enrollment into Medicare.

Requesting A New Determination

If SSA determines that you have an IRMAA, they will mail you a notice of initial determination for your adjusted premium numbers. You are able to request a new determination due to a 'life changing event' that caused a decrease in your income in the last two years since your tax return. Below are a few 'life changing events' that could qualify you for a lower IRMAA or dropped IRMAA entirely:

- Retirement or Spouse Retirement

- Loss of Pension

- Death of a Spouse

- Divorce/Marriage

- Loss of Income Due to Natural Disaster, Fraud, Disease, ect.

- Bankruptcy

To request a new determination, you must file a 'Medicare IRMAA Life Changing Event Form' (SSA-44) with the SSA. You will need to provide documentation of income upon filing this change to your income. This appeal can take several weeks to hear back on.