Part B & D IRMAA

It is important to understand what you will be paying for your Medicare Part B and Part D premiums. You must also be aware that there are penalties for late enrollment into either part without a qualifying waiver. Below we will describe how the Income Related Adjustment Amount (IRMAA) works for 2023.

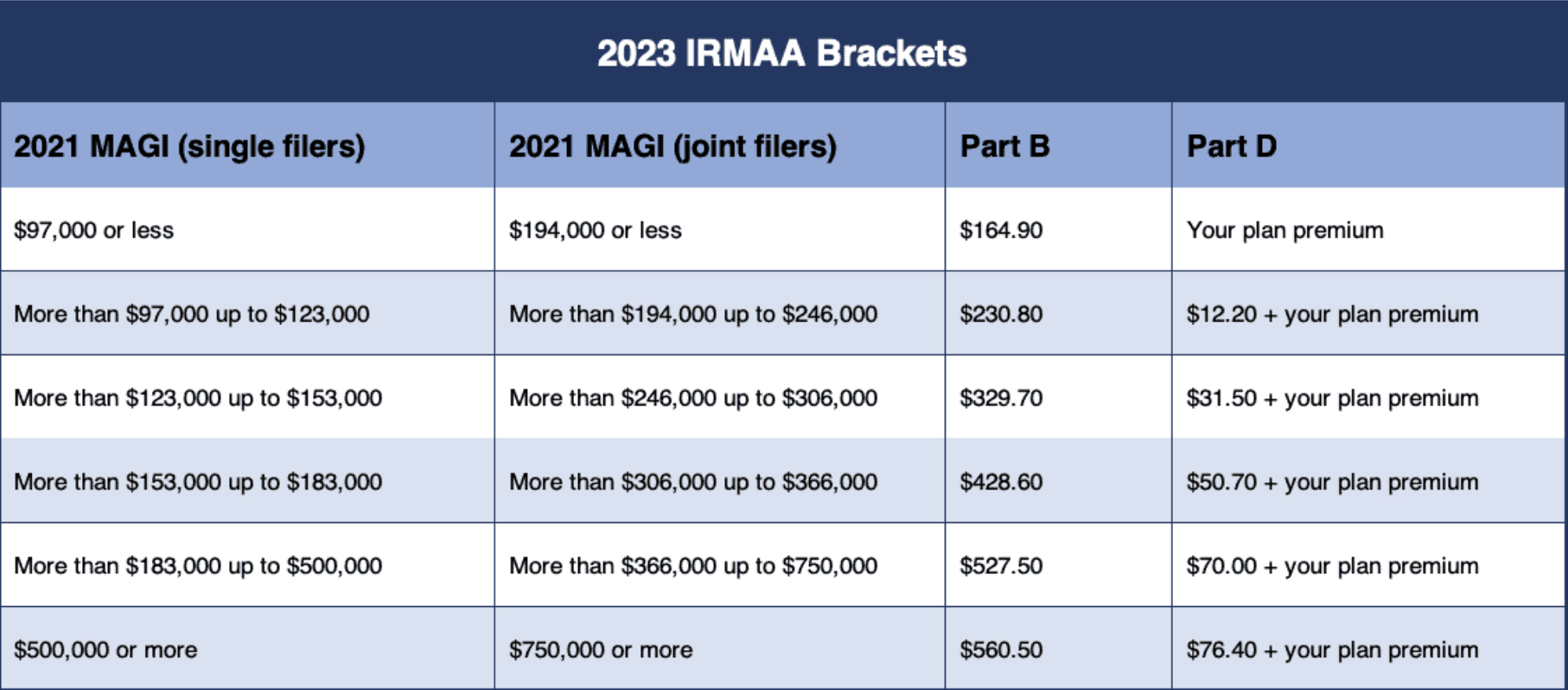

If your modified adjusted gross income (MAGI) is above a certain level of income for both you and/or your spouse, you may have an IRMAA. Medicare will use your MAGI on your IRS tax return from two years prior to the current year to calculate your premiums. For 2023 they will look at your income level from 2021.

Medicare will send you a notice of both your Part B & D IRMAA, based on that income level. You are able to appeal the IRMAA depending on if you have a qualifying change in your income level from the level it was two years prior. You can do so on the Social Security website by filling out the IRMAA appeal form and sending it in. The chart below shows the IRMAA amounts for this year given your 2021 income level:

Penalties for Late Enrollment in Parts B & D

These penalties are not a one time fee, they are added to your monthly premiums as long as you are enrolled in Medicare. Waivers for Part B include; qualifying employer coverage from a job in which you or your spouse worked where you have 20 or more employees. COBRA and VA/TRICARE are not valid waivers for Part B. Waivers for Part D include; qualifying employer sponsored coverage from a job in which you or your spouse worked where you have 20 or more employees. COBRA, VA/TRICARE, or any other credible coverage are waivers for Part D.

Part B Penalty

Each year that passes after you become Medicare eligible without a credible Part B waiver you will be required to pay a penalty of 10% of the premium for that year on top of the premium amount adjusted with your MAGI. For example, if you waited two years to enroll in Part B after you became eligible without a waiver you would pay an additional 20% of the $164.90 for a total of $197.88 per month (IRMAA not calculated). This 20% penalty will be paid every month your premium is due while you are enrolled in Medicare, for many this will be the rest of their life.

Part D Penalty

Each month that passes after you become Medicare eligible without a credible Part D waiver you are required to pay a 1% penalty. You are required to pay this penalty if you; do not take a Medicare drug plan when first eligible or have a credible waiver, or go without credible drug coverage for a period of 63 days or longer. For example, if you go 13 months without credible drug coverage after your become Medicare eligible you will pay roughly $4.26 extra per month using the 2023 national base beneficiary premium of $32.74 to calculate. In this situation, you would pay a total of $36.99 per month for coverage (IRMAA not calculated) so long as you are enrolled in Medicare, this penalty lasts for your lifetime while on Medicare.